Digitizing the entire home loan process

Building an Operating System in the cloud for Banks and NBFCs

Background

Loktra is a SaaS platform company that offers cloud-based software solutions for Small Finance Banks (SFBs) and Non-Banking Financial Companies (NBFCs). It aims to digitize the traditional banking workflow, thereby creating a cloud Operating System to fulfill all of a bank’s needs.

Currently, more than 80% of bank leads in India come from offline channels, leading to decentralized nurturing and onboarding processes. However, the absence of centralized data makes it difficult for banks to tailor product offerings accurately. Loktra's offerings provide a holistic view of the entire customer journey with the bank, addressing this challenge effectively.

Digitizing the Banks, one workflow at a time

Our challenge was to digitize the end-to-end process of banks, starting with granting home loans to customers end-to-end on our platform: encompassing approval, underwriting, and disbursement.

The design challenge lies in effectively gathering and presenting sensitive customer data to multiple bank stakeholders over an extended timeframe. With various stakeholders involved and their approval required for progression, our objective is to develop a tool that is both secure and comprehensive, enabling stakeholders to make informed decisions. Below is what a typical process for a single home loan looks like from capturing lead to disbursement.

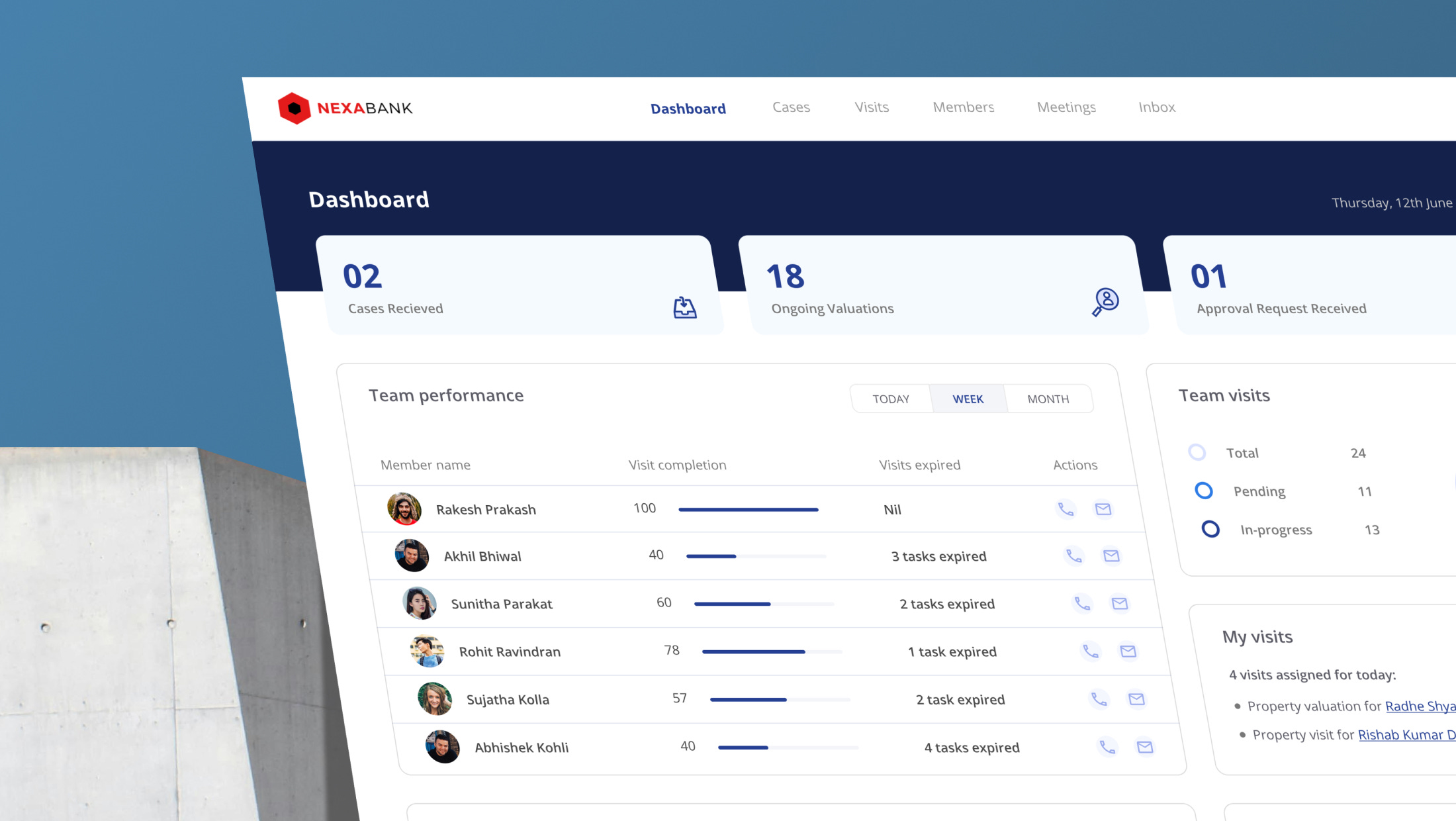

A birds eye view of leads & team members for bank managers

Once the lead details have been captured in our Field Officer App, they can be automatically assigned to the appropriate branch manager for further nurturing. We built tools for the manager to get an overview of workload of their branch teams and allocate them leads for further nurturing based on the stage the lead is in.

Building a digital profile

As the leads are nurtured and moved in to different phases, a record of all the data and documents collected, team members involved with the case and their comments are added into a collective profile of the lead.

This data is vast and varied and spans across multiple domains and contains sensitive data. So we designed the profile in a way that it requires view access control based on the profile type looking at the lead. The data is categorized based on the step of the loan process the lead is in. Team members can even share segments of the profile to members assigned to that lead for approvals or comments. For the manager, they get a bird’s eye view of the status of the lead and any roadblocks or concerns coming their way.

The Result

Early customers who demoed the prototype left with positive reactions and excitement about the future trajectory of this feature.

Expanding into the loan segment, starting with home loans, broadened our customer base from SMBs to include NBFCs